When should you start saving for your retirement? The most accurate answer is yesterday. Time is by far the most important factor on saving for your future. Starting early, combined with the effects of compounding interest can make a world of difference of what your retirement may look like in the future.

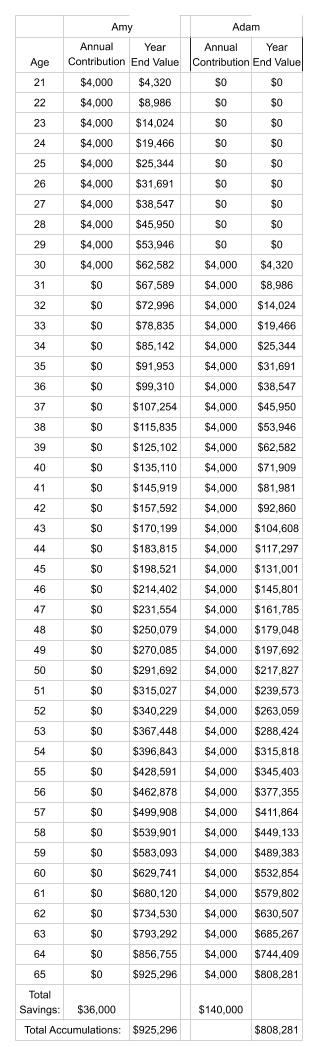

To best illustrate this, I have created a table representing the saving manner of two different individuals: Amy and Adam.

Amy started saving for her retirement as soon as she entered her professional career. She thoughtfully considered her budgeting and planning and knew saving small amounts early would benefit her down the road.

Adam thought that as long as he started saving by the time he was 30, he would have plenty of time to save for his retirement.

For representation, Amy is expected to only save until the age of 30. Saving $4,000 a year for 9 years Amy will contribute a total of $36,000 to her retirement account.

Adam will start at age 30 like he planned, and then save until the age of 65. Just like Amy, Adam saved $4,000 a year for his retirement. In total, Adam contributed $140,000 to his retirement account.

Because Adam put away almost four times the amount of money than Amy, you would imagine he is in a better position for retirement. Let’s go to the chart and take a look (see chart to the right).

For this model, we assumed an annual return of 8%. Having contributed almost four times more than Amy, Adam still had over $110,000 less in his retirement account at the age of 65! This is all due to the timing of when they started saving combined with compounding interest. Your money can work for you, just as you work for your money!

This example is not trying to say you should start saving early and then stop saving at a certain age, but rather you should always be saving and let the savings continue to accumulate for your retirement. If Amy were to continue to save the $4,000 a year, she would end up with a retirement accumulation of over $1.6 million dollars. That’s real money!

If you have not yet started a savings vehicle, it’s not too late. Catching up can be as simple as making a few extra contributions a year. Making the decision to start is life changing.

For best results on saving, set up a system where the savings you plan take out of each paycheck directly deposits to your retirement account. Putting it on autopilot makes the savings much less noticeable. For most people, it’s difficult to save once their funds are deposited in their checking account.

As you grow in your career, allow your retirement investments to grow proportionally. As you feel more comfortable with the amount you are sending to savings, challenge yourself to increase the amount and reap the benefits! Take control of your retirement early so you can enjoy the freedom financial independence.

Start saving for your future today!

-Austin