Answer: Maybe not the account you think!

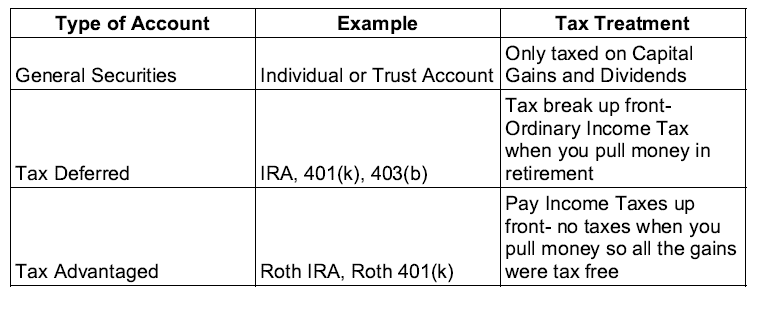

This is a pretty common conversation that we have with clients. Here is a handy chart outlining the different options and their tax treatment:

Tax Deferred – Pay it Later

Tax deferred retirement accounts, like 401(k)’s, allow you to take money out of your paycheck to invest. You do not have to pay taxes on this money in the year you earned the income. As a result, this lowers your current years taxes. This is the incentive the IRS is giving you to save money for your retirement. This sounds good, but let’s make sure we understand how the IRS eventually gets their cut of this money.

money in the year you earned the income. As a result, this lowers your current years taxes. This is the incentive the IRS is giving you to save money for your retirement. This sounds good, but let’s make sure we understand how the IRS eventually gets their cut of this money.

Let’s say you have been working hard for 40+ years, diligently putting money into your 401(k) and now it is time to retire and live off of this money. You picked some nice investments and your nest egg has grown quite a bit. As you start to withdraw this money, whatever amount you take each year, ordinary income taxes are paid on that amount. Important note: if you want to take any of this money before you are eligible (generally age 59.5) you would have to pay tax penalties.

Tax Advantaged – Pay Now and Never

Roth retirement accounts are similar to tax deferred accounts; however, your savings are not deducted from your current years taxable  income. In exchange for giving up the tax break up front you receive a tax break later. For Roth accounts when the time comes to use the money you saved, you will not pay any income taxes on your withdrawals. Taxes were paid when you earned the money as you were working. This account too has some restrictions and tax penalties if you want to use the money before you are eligible.

income. In exchange for giving up the tax break up front you receive a tax break later. For Roth accounts when the time comes to use the money you saved, you will not pay any income taxes on your withdrawals. Taxes were paid when you earned the money as you were working. This account too has some restrictions and tax penalties if you want to use the money before you are eligible.

General Investment Account – Your Rules Your Money

The general investment account does not receive any tax break but does provide much more flexibility. Both of the retirement accounts listed above have restrictions on how much money you can save every year. The general investment account does not have any restrictions. A big mistake many people make is they let the government rules for retirement accounts determine how much they save. When you use a general investment account, you eliminate all of the red tape and rules on how much you can save or when you can use it. Also, the only taxes that are paid from this account are the gains it accumulates over time at capital gains tax rates, not as ordinary income.

My Answer

So back to the original question, which type of investment account should you use? It depends.

The only way to know is to know exactly what the future will look like. You would have to know what tax rates are going to be and how much you will have accumulated. Unfortunately since you do not have a crystal ball, maybe the best thing to do is spread money into all of these different types of accounts…tax diversification!

Just like investment diversification, this spreads out your risk. We have already seen one big tax change in recent years, and we should expect more tax changes in the future.

In Summary

Traditional retirement accounts create tax savings up front, Roth retirement accounts create tax savings for later and general accounts provide the flexibility to do whatever you want with your money. Filling all of these different buckets as much as you can will create the best opportunity for success.

Survey Question

Which account type do you like best?

►The flexibility of a General Investment Account?

►The tax-deferral of a IRA or 401(k)?

►The tax free gains of a ROTH?

We’d love to hear from you!

Austin

If you enjoyed reading this, check out a related post here.

.png)

Leave a Comment